Going cashless would make budgeting difficult and would be a “major inconvenience” to another 15 million, the Royal Society of Arts (RSA) found. Thousands of bank branches have closed in recent years, and access to cash withdrawals is under threat. The RSA said the “dash to digital” held huge risks as finances were stretched. “For millions of people, their relationship with cash is critical to the way they manage their weekly budget,” said Mark Hall, author of the report called The Cash Census. “Despite online banking and shopping becoming more common, our research shows the percentage of the population wholly reliant on cash is unchanged.”

The report said that although millions of people benefitted from the convenience of things like smartphone payments, others felt forced into a world they were not equipped for. An estimated 15 million people used cash to budget, the report said, which was all the more important when the cost of living was rising. The constituencies of Liverpool Walton and Bradford South had the smallest decline in cash withdrawals, and were among the most deprived in the UK, it said.

Among those keen to keep cash going is Joanne Batty, from Leeds, who said it was still the “easy and simple” way to pay and manage finances. “It is stress and hassle-free,” she said, explaining that she liked the control you had as a consumer with notes and coins. The 51-year-old said that a “traumatic” episode in which she was the victim of fraud meant she was now far more sceptical about online and digital payments. The RSA – or its full name – The Royal Society for the Encouragement of Arts, Manufactures and Commerce – used surveys and interviews during its research.

It also suggested that, in contrast to those dependent on cash, there were another 11 million people who were cashless converts. They strongly preferred digital payments and saw no benefit in using cash. They included Craig Purr, a 32-year-old commercial insurance broker, who said that cash was more inconvenient because you usually had to go to an ATM to get hold of it. Mr Purr, from Cambridge, said he carried cards in his wallet instead or used his smartphone to pay. “My personal, and selfish, point of view is that we do not need cash. It is out of date because technology is evolving so fast,” he said.

This is the first major study on the topic of cash reliance since the Access to Cash Review in 2019. The author of that 2019 report. Natalie Ceeney, said: “The question we asked three years ago was whether the UK is ready to go cashless? The answer is still no.”

Among the recommendations in the latest RSA report were:

- Legislation to ensure everyone has access to cash near their home

- Payment in cash must be accepted for essential services such as school dinners and council tax bills

- Digital money lessons should be taught from primary school level onwards

- No region should miss out on the roll-out of broadband

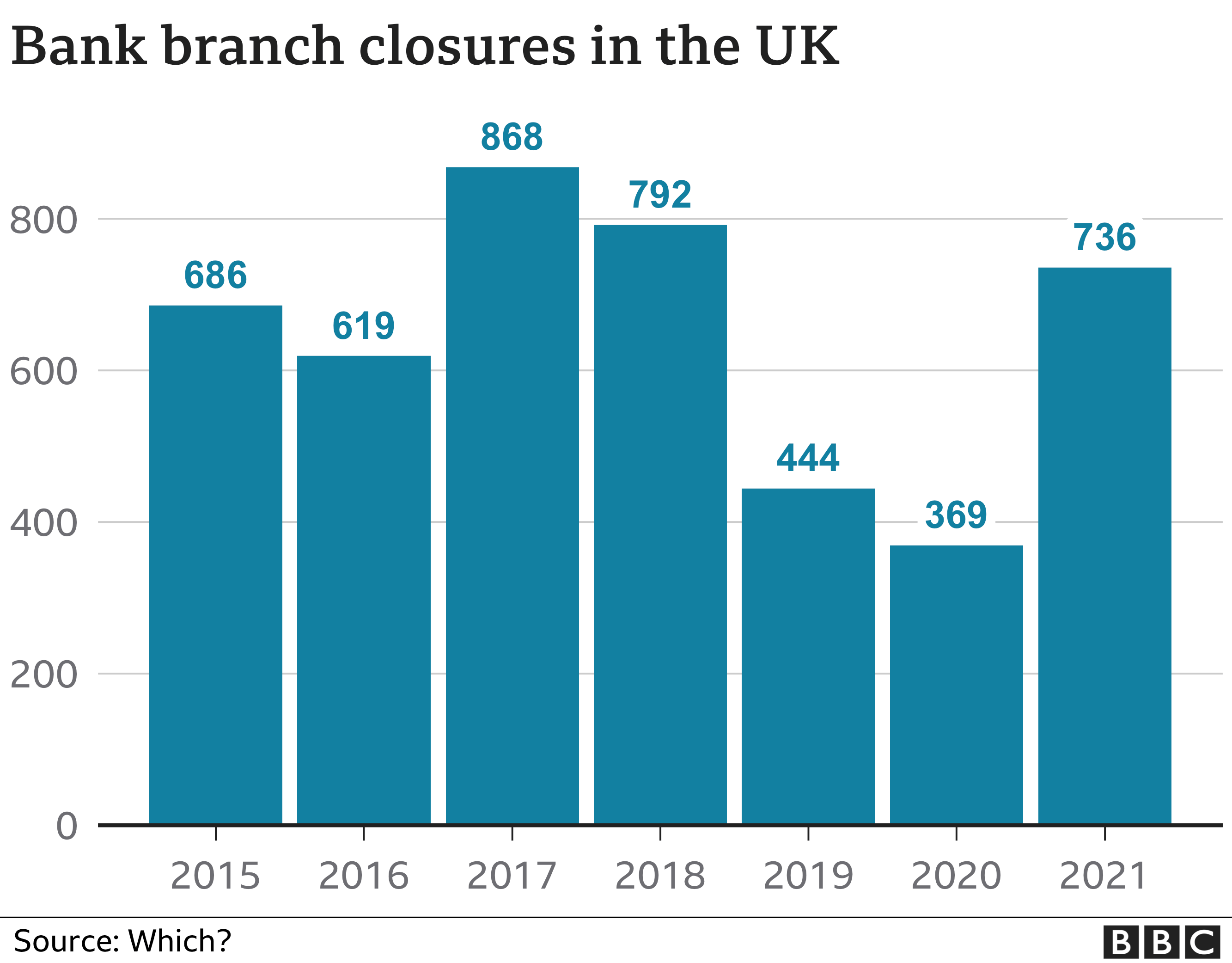

Martin McTague, from the Federation of Small Businesses, said: “One in four small High Street businesses say cash is still the most popular payment method among customers. “This new report rightly suggests a combination of innovation in the free access to cash space and investment in digital capability as the way forward.” The closure of thousands of bank branches and ATMs has ignited a debate about access to cash, and the ability of small businesses to cash their takings nearby.

Major banks recently signed a new voluntary agreement which means an independent assessment of local needs will be carried out each time a branch is shut. These reviews could recommend a shared branch is opened, an ATM installed or a Post Office upgraded. Banks will commit to delivering whatever is recommended. The government is legislating to give the Financial Conduct Authority oversight of access to cash. It has also paved the way for more convenience stores to offer cashback to customers, even if they are not making a purchase.

![]()