Shared banking hubs should be opened more quickly to help those who feel uncomfortable managing their finances online, a charity has said. Age UK said many people who were older or on lower incomes wanted to interact in person when dealing with money. Its survey suggested that 27% of over-65s and 58% of over-85s relied on face-to-face banking. Hundreds of bank branches have closed in recent years but only four premises shared by different banks have opened.

Banks have pointed to the large reduction in branch use – a trend accelerated by the Covid pandemic – and the popularity of managing money via smartphones, as good reasons for diluting their branch network. But Age UK said its survey suggested those who were most likely to feel uncomfortable using online banking were aged over 85, female, on a low income, or more disadvantaged than their counterparts. Among those who were uncomfortable, the key concerns about online banking were fraud and scams, a lack of trust in online banking services, and a lack of computer skills.

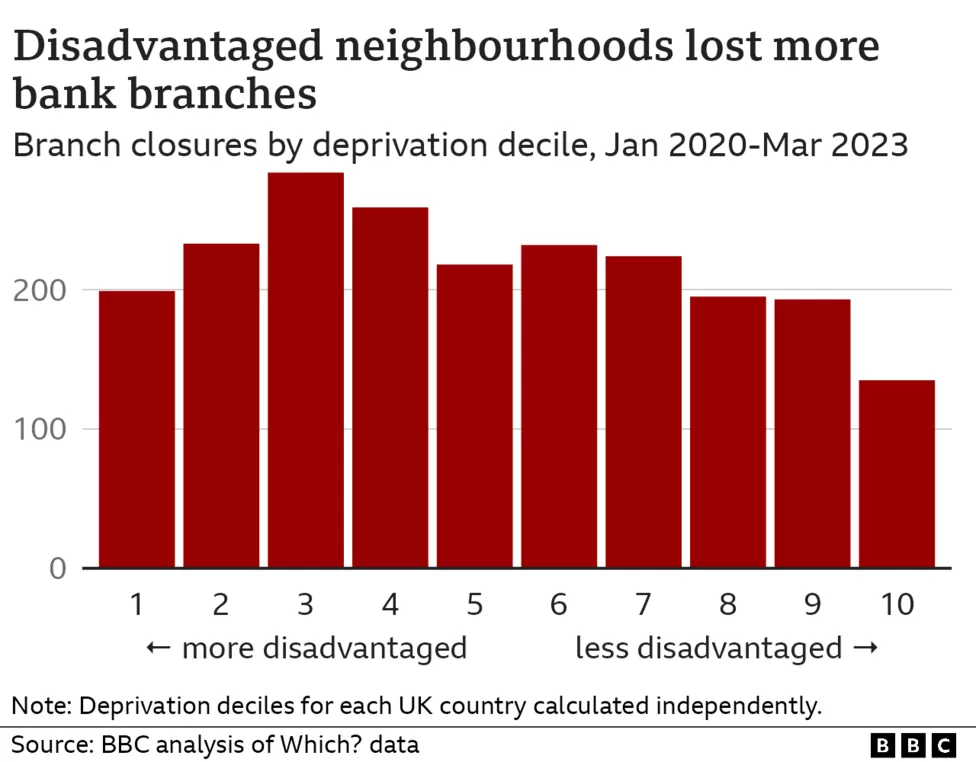

The survey size becomes relatively small when broken down, but Age UK said that 34% of those with an annual income of less than £17,500 mainly banked face-to-face, compared to 15% of those with an income of £30,000 to £49,999 a year. Separate figures show that, since the start of 2020, more branches have closed in poorer parts of the UK than in better-off areas.

In its report called “You can’t bank on it anymore”, Age UK said it was vital that physical banking spaces were protected. Charities and consumer groups have called for an acceleration in the introduction of banking hubs, when all branches have closed in an area. These hubs see counter services run for the major banks, often by the Post Office, and dedicated rooms where customers visit community bankers from their own bank. The costs of the hub are shared between the participating banks. However, only four hubs have opened so far, while an average of 54 branches have shut each month since January 2015, according to consumer group Which?. Another 48 hubs have been agreed for areas across the UK, but they can take 12 months to find a premises and get up and running.

Caroline Abrahams, charity director at Age UK, said: “We need to face up to the fact that huge numbers of older people, the oldest old, especially, are not banking online. Even older people who do bank online often want the ability to talk to a bank employee in the flesh about some kind of transaction. “A lack of face-to-face banking will only serve to further exclude the millions of people on a low income who have no or limited access to the internet.”

John Howells, chief executive of cash machine and cash access network Link, said: “It is vital to protect face-to-face banking services for the millions of consumers who rely on cash. “The proposed national network of shared banking hubs being provided by the banking industry are proving a popular and easy to use way to do that.

![]()