The government has ruled out introducing major financial support to mortgage holders over fears it would drive the cost of living higher. Chancellor Jeremy Hunt said offering mortgage relief schemes would “make inflation worse, not better”. But he said he would meet mortgage lenders later this week to ask what help they could give to households struggling with rising bills. Homeowners are facing soaring mortgage costs due to higher interest rates. But the government said it was “spending record amounts” helping people and that it already had “specific tools” to provide support, citing help – in the form of a loan – for people who receive benefits. A spokesperson added households had been provided with £3,300 each on average to help ease the cost of living pressures.

Conservative MP Sir Jake Berry asked Mr Hunt in Parliament on Tuesday to consider “reintroducing a bold Conservative idea of mortgage interest relief at source” to avoid what he described as a “mortgage bomb” happening. “If we don’t help families now all the other money we have spent helping them will be wasted if they lose their home,” he said. But the chancellor said the government was not considering such a move. “Those kind of schemes, which involve injecting large amounts of cash into the economy, would be inflationary,” he said.” As much as we sympathise with the difficulties and do everything we can to help people seeing their mortgage costs go up, we won’t do anything that would mean we prolong inflation.” Mr Hunt said he would be meeting the principal lenders to ask what help they could give to people struggling to pay more expensive mortgages and “what flexibilities might be possible for families in arrears”.

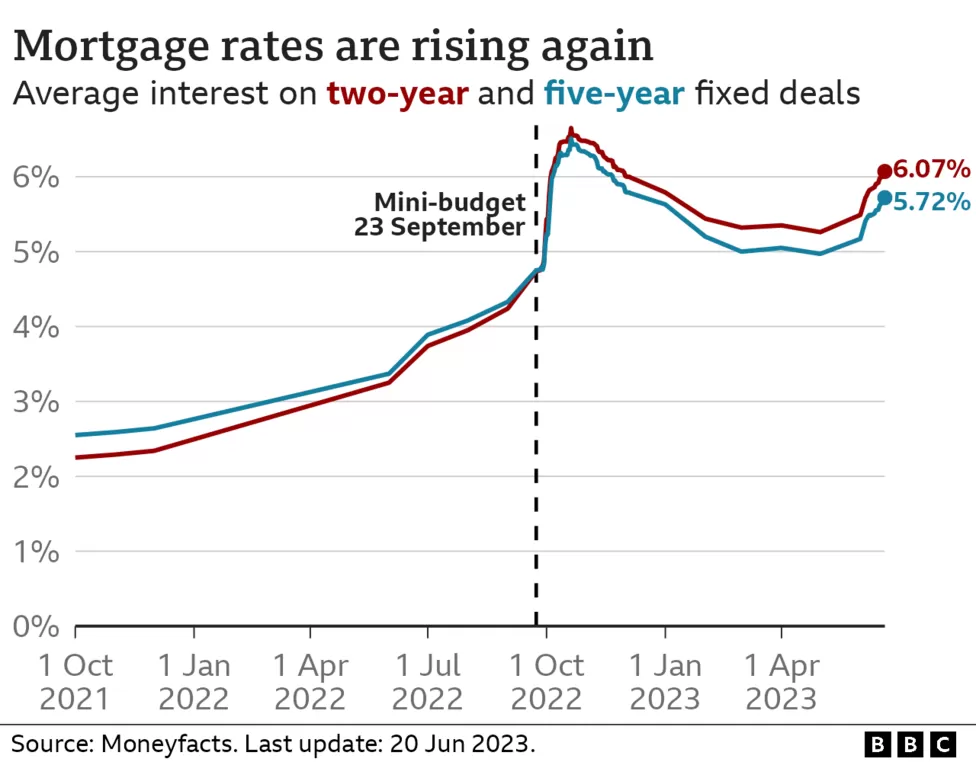

Inflation, which is the rate at which prices rise, stood at 8.7% in April, meaning consumer prices overall were 8.7% higher than they were in April 2022. In an attempt to reduce inflation, the Bank of England has been raising interest rates, making the cost of borrowing, including for a mortgage, more expensive. It is expected that the Bank will raise rates further this week and that they will stay higher for longer. Prior to the Bank’s decision, expectations of a rise has already been reflected in the funding cost of mortgages, hitting new borrowers, and people trying to remortgage.

Lenders have been pulling deals and putting up rates at short notice and on Monday the average rate on a two-year fixed deal rose above 6%. The Liberal Democrats also called for mortgage relief and a mortgage protection fund, but Treasury minister Andrew Griffith said such policies would delay bringing down inflation. Labour’s shadow chancellor Rachel Reeves asked Mr Hunt where are families “going to get the money to pay the Tory mortgage penalty”, claiming that higher costs were a “a consequence of the Conservative mini-budget last year and 13 years of economic failure”.

![]()