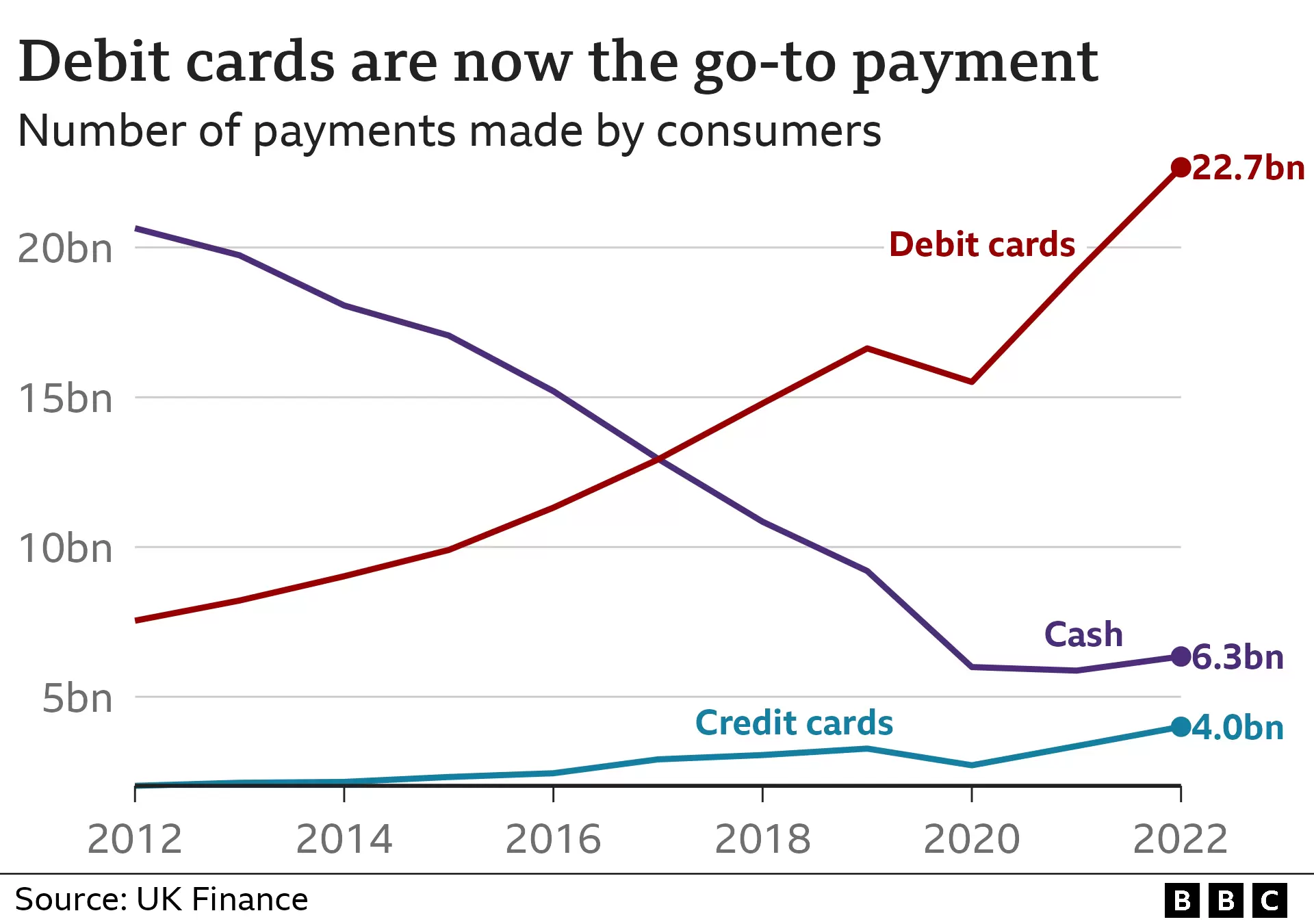

Payments made with cash rose for the first time in a decade last year as consumers struggled with rising prices. But the number is still dwarfed by debit card use which accounted for half of all payments, its highest ever level. Consumers often say they find it easier to manage their money using cash. However, UK Finance, which compiled the data, said it expected cash use to decline over the coming years, once the current financial squeeze has eased. Even during the cost of living pressures and the emergence from lockdowns, it said nearly 22 million people only used cash only once a month or not at all last year. That compares with just under one million who mainly used cash.

Hybrid working increases card use

People are still most likely to pay for things using a debit card. Part of the reason for that is that people use them to make contactless payments for low-value buys in shops, whereas in the past they might have used coins. The typical amount spent for each contactless card payment was £15.10. Debit card use rose last year to account for half of the 46 billion payments made by consumers and businesses last year, according to the UK Finance data. Among consumers, debit cards were used in 57% of transactions.

Some of the rise was driven by people working part of the week at home, and only commuting on the other days. People are travelling to the office less but making more transport payments. There was a slump in the purchase of annual or monthly season tickets, with consumers instead using their debit card more frequently to pay for individual journeys. Cards loaded onto smartphones and watches are included in the total. The research also pointed to anecdotal evidence that suggested people were making more visits to supermarkets but spending small amounts each time, rather than doing one large weekly shop..

Squeeze on limited budgets

Low-cost grocery shopping may also have been the result of consumers trying to cut back as prices increased. In another attempt to manage limited budgets, the number of payments made using physical cash increased by 7% last year, compared with 2021, to 6.4 billion payments. It was the second most popular method of payment, but still only accounted for 14% of the overall total, having been dwarfed by card use. “There is a wide variety of payment methods available in the UK and each provides specific benefits to the people using them,” said Adrian Buckle, head of research at UK Finance.

“During 2022 we saw increased use of contactless, online banking and mobile payments, although cost-of-living challenges meant that some people preferred to use cash to help with their budgeting.” Sitting having a coffee together in Bromley, south east London, Sarah Maxwell-Scott and Debbie Clark say they prefer opposite payment choices. Ms Maxwell-Scott, an accountant, said she made most of her purchases by card, because shops steered customers in that direction, and mainly owing to “laziness and convenience”. But Ms Clark, a retail assistant, said: “I like to have cash on me because you know what you’ve spent.”

Cash access rules

The figures show the humble cheque continued its decline – the average person writes one less than once every two years. Most banks no longer automatically send chequebooks to their customers. While they are in managed decline, there has been a concerted campaign to save cash for those who rely on it. In August, the Treasury announced banks faced fines if they failed to provide free access to cash withdrawals for consumers and businesses. A new policy will state that free cash withdrawals and deposits must be available within one mile for people living in urban areas, or three miles in rural areas.

Graham Mott, from Link – which oversees the UK’s cash machine network, said millions were turning to notes and coins during tough economic times. “[We are] making sure every high street has free cash access. Where the last machine closes, we replace it. We will keep doing this for as long as people need cash,” he said. The Post Office network said it had seen the highest number of cash transactions on record between June and August. Many of its counters are being used by those who prefer cash, when bank branches have closed in certain areas.

How can I save money on my food shop?

- Look at your cupboards so you know what you have already

- Head to the reduced section first to see if it has anything you need

- Buy things close to their sell-by-date which will be cheaper and use your freezer

![]()