Halifax is set to sharply cut rates on some of its fixed mortgage deals, potentially easing pressure on some homeowners. The UK’s biggest mortgage lender will reduce rates by up to 0.71 percentage points from Friday, with a five-year fixed deal priced at 5.39% from 6.10%. NatWest will follow suit with HSBC and Nationwide having cut some rates. Mortgage costs have risen as the Bank of England has pushed up interest rates in a bid to tame soaring prices. Halifax will cut rates across a range of products, with smaller reductions on two-year fixed deals and some aimed at first-time buyers. Other big mortgage lenders have been lowering rates this week after the latest data on inflation – which measures the rate of price rises – was better than expected.

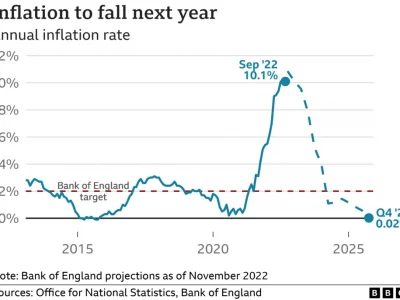

It could suggest the Bank of England’s interest rate might not stay as high for as long. While inflation has slowed, at 7.9% it remains nearly four times higher than the Bank of England’s 2% target. The Bank of England lifted interest rates for the 14th time in a row last week from 5% to 5.25%. Higher interest rates mean people have to pay more for their mortgages, for example, which may mean they have less money to spend on other things. While falling mortgage rates will be welcomed by homeowners, in practical terms they still face much higher repayments than previous years.

There is no sign of a return to the ultra-low mortgage rates of less than 2% that many would have seen on their previous deal. Before rates started to rise in December 2021, there had been a decade of low household borrowing costs. Among the rate reductions, HSBC has cut some homebuyer, first-time buyer and re-mortgage rates on offer by up to 0.35 percentage points, as well as adding a £500 cashback incentive to some deals. Nationwide is also reducing the rates on offer for those re-mortgaging by up to 0.35 percentage points across two, three and five-year fixed deals.

‘Slowing down’

Aaron Strutt, from mortgage broker Trinity Financial, said: “More of the larger banks and building societies are lowering their rates, which is good news especially given the scale of rate increases we have seen in recent months. “It would not be a surprise if more of them improve their rates over the coming weeks,” he added. “Lenders are starting to realise the market is slowing down, and they need to improve pricing to attract more borrowers.”

Andrew Bailey, governor of the Bank of England, recently said, however, that interest rates were not likely to fall until there is “solid evidence” that price rises are slowing. It marked the first time the Bank acknowledged that interest rates would stay higher for longer. Chancellor Jeremy Hunt also said that rising interest rates would be “a worry for families with mortgages and for businesses with loans”, but reiterated the government’s aim to cut inflation. A sharper than expected drop in inflation in June has had a major effect on rates and lenders will be alert to any changes in forecasts on the wider economic climate.

New research on Thursday from the Royal Institution of Chartered Surveyors (RICS) suggested that the jump in mortgage rates was weighing heavily on consumers. Its survey found that UK house prices had seen the most widespread falls since 2009 during July. Meanwhile, new data shows that the number of homeowners with mortgage arrears rose in the three months to June. UK Finance, which represents the banking industry, said that 81,900 homeowner mortgages were in arrears over the period, up 7% compared with January to March and 9% ahead of the same time last year. Housebuilder Persimmon reported a sharp fall in sales for the first six months of the year as it sold considerably fewer homes.

The business said it had completed 4,249 new builds over the period, down from 6,652 in the same period last year. Persimmon’s chief executive Dean Finch said it had delivered “robust” sales and made savings despite “higher mortgage rates, the removal of Help to Buy and significant market uncertainty”. Higher interest rates are also having an impact on people who are renting a home. With landlords’ incomes being squeezed, RICS warned that rents were likely to carry on rising as they seek to pass on any increases to their tenants. Alternatively landlords could choose to sell up, leaving fewer properties for people to rent.

What happens if I miss a mortgage payment?

- If you miss two or more months’ repayments you are officially in arrears

- Your lender must then treat you fairly by considering any requests about changing how you pay, such as lower repayments for a short time

- They might also allow you to extend the term of the mortgage or let you pay just the interest for a certain period

- However, any arrangement will be reflected on your credit file, which could affect your ability to borrow money in the future

![]()